Politics

U.S. Supreme Court strikes down Biden student loan forgiveness plan

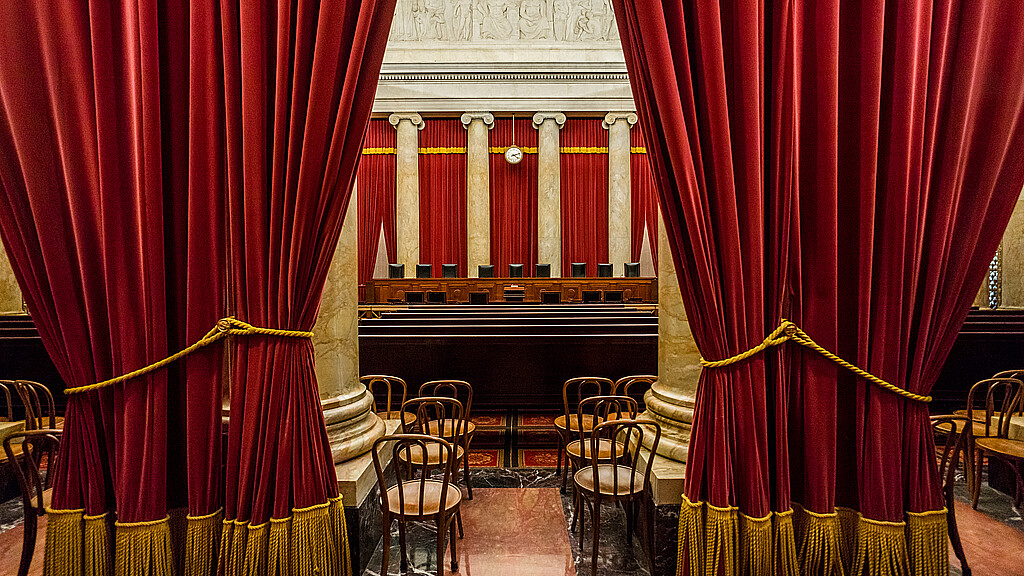

The U.S. Supreme Court ruled on Friday 6-3 that the Biden White House cannot student loan debt without Congressional approval

June 30, 2023 11:24am

Updated: June 30, 2023 12:04pm

The U.S. Supreme Court ruled on Friday 6-3 that the Biden White House cannot eliminate student loan debt without Congressional approval.

The loan forgiveness plan was central to a campaign point that President Biden ran on in 2020, dealing a major blow to the administration and his potential campaign platform for 2024.

The high Court ruled in Department of Education v. Brown that the administration does not have the constitutional authority to unilaterally eliminate what would have amounted to hundreds of billions of dollars in student loan debt without congressional approval, a point even former Democratic House Speaker Nancy Pelosi made.

The Biden administration argued the president had such authority under the decades-old Higher Education Relief Opportunities for Students Act, a move that was expected to eliminate total student loan debt for an estimated 14 million people.

“The Secretary’s [of Education] plan canceled roughly $430 billion of federal student loan balances, completely erasing the debts of 20 million borrowers and lowering the median amount owed by the other 23 million from $29,400 to $13,600,” Chief Justice Roberts wrote in the majority opinion. “Six states argued that the HEROES Act does not authorize the loan cancellation plan. We agree.”

The HEROES Act was passed by Congress in 2003 to help U.S. soldiers while serving overseas in Afghanistan or Iraq. The law was expanded later to give the Dept. of Education the freedom to change terms of other federal student loans amid national emergencies.

In this case, the White House tried to use the COVID-19 national emergency even though it ended on May 11.

Still, the administration argued the economic impact of the pandemic would last longer, making loan forgiveness imperative.

Under the president’s plan, the DOE would have forgiven up to $10,000 in federal student debt for Americans that earn less than $125,000 annually and $20,000 for low-income Pell grant recipients.

Job Creators Network President Alfredo Ortiz said Friday's decision saved U.S. taxpayers a huge and unjustified expense, rightfully compelling Congress to address rising college costs.

“With this ruling, the Supreme Court has protected hardworking Americans who have paid back their student loans or never went to college from having to unfairly cover the college debt of others,” Ortiz wrote on Fox News shortly after the ruling was issued.

“A student debt jubilee would have let colleges off the hook for their role in this crisis and given them a blank check to keep on raising costs, secure in the knowledge that the federal government will step in when debts get out of hand. Lawmakers can now begin to address the problem's root,” he argued.

President Biden said an announcement would come later Friday about how the administration plans to act in the aftermath of the 6-3 ruling.