Business

Justice Department accuses Texas developer of targeting Hispanics with predatory loans and subpar housing

The Justice Department says Hispanics were targeted through the China sponsored social media platform TikTok by advertising with national flags from their home countries and popular Latin American music

December 21, 2023 8:10am

Updated: December 21, 2023 8:11am

The U.S. Department of Justice and Consumer Financial Protection Bureau (CFPB) have sued a Texas developer they say targeted Hispanic Americans with false advertising and subpar housing as part of an illegal predatory lending scheme.

The communities, known as Colony Ridge Development, LLC, Colony Ridge Land LLC, and Colony Ridge BV are accused of working with Loan Originator Services LLC as part of a scheme to manipulate Latino homebuyers with false advertising by promising flood prone houses equipped with basic utilities.

U.S. officials say Hispanics were targeted through the China sponsored social media platform TikTok, and other social media sites by advertising with national flags from their home countries and popular Latin American music.

The ads promised small, non-refundable deposits and no credit checks, the complaint says.

“The CFPB and Justice Department lawsuit in federal court charges Colony Ridge with a slew of illegal misconduct and seeks to stop this set-up-to-fail scheme that has led thousands of families to lose their dreams of homeownership,” CFPB Director Rohit Chopra said in a statement.

“Our investigation uncovered that Colony Ridge is baiting borrowers with lies, saddling families with predatory loans for homesites that the company knows have repeatedly flooded with raw sewage and lacked basic utility infrastructure.”

The federal government’s lawsuit, which was filed in the Southern District of Texas on Wednesday, follows other concerns by Texan lawmakers who held a special session about the community several months ago.

The Justice Department’s lawsuit accuses the developers of exploiting language barriers, and “lured tens of thousands of Hispanic consumers into using predatory seller financing to purchase land, promising they would, “Logra el sueño Americano aqui!” which means, “Achieve the American dream here!”

However, the Justice Department says that many Hispanics were manipulated into seller-financed loans they cannot afford by entering contracts in English, which many of them did not understand.

“Today’s complaint alleges that Colony Ridge targeted Hispanic consumers with predatory loans, misled borrowers about the water, sewer, and electrical infrastructure on its lots, and exploited language barriers by conducting most of its marketing in Spanish while offering important transaction documents only in English,” said Attorney General Merrick B. Garland in a statement.

While the communities advertised their buyers would save money, many Latino families ended up losing money to make their properties flood proof, a move that forced some into foreclosure, the Justice Department alleges.

The community targeted so many Hispanics that false rumors erupted across the Lone Star state that it was a haven for illegal immigrants and even drug cartels.

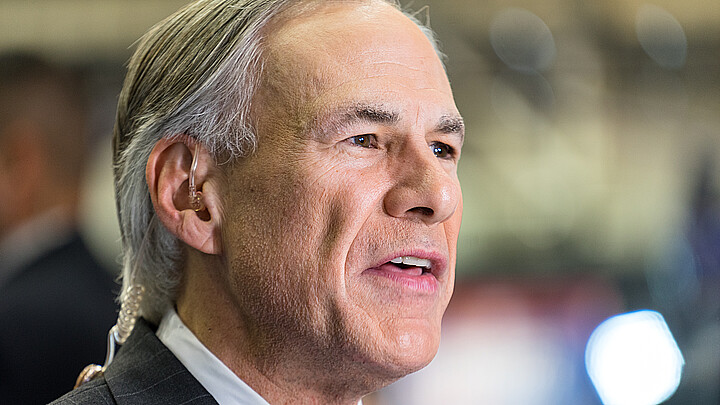

It was even one of three issues Gov. Greg Abbott directed the Texas Legislature to address when he called lawmakers into a third special session earlier this year. After allocating $40 million to the Texas Department of Public Safety to investigate the development, law enforcement agents dispelled the rumors, saying it was just an area with explosive growth.

John Harris, the CEO of Colony Ridge, said in a statement that his company was “blind-sighted” by the federal government’s lawsuit.

“We are concerned that the Justice Department would pursue this action. The lawsuit is baseless and both outrageous and inflammatory. Our business thrives on customer referrals because landowners are happy and able to experience the American Dream of owning property,” he said in a statement.

“We loan to those who have no opportunity to get a loan from anyone else and we are proud of the relationship we have developed with customers. We look forward to telling the true story of Colony Ridge.”

According to the lawsuit filed in the Southern District of Texas, Colony buyers entered into loan agreements from 2017 to 2021 that were triple and even quadruple the average rate for Americans.

While the standard fixed-rate loan was 2.35% to 4.05%, the Justice Department says that Colony was charging an average of 10.9% to 12.9%, a move that was defended by the developer.

In an interview with The Associated Press, Colony Ridge Developer Trey Harris, who is also the brother of John Harris, said the company justifies the higher interest rates since their customers cannot get ordinary loans from regular commercial lending institutions.

The lawsuit also alleges that houses that went into foreclosure were repurchased for a fractional cost and then resold at higher prices.

U.S. Assistant Attorney General Kristen Clarke of the Department’s Civil Rights Division said in a statement that nearly 1 in every 3 Colony Ridge loans failed within three years, a staggering number which is 10 times the national rate.

According to Clarke, that means thousands of Latino buyers have lost their homes “because of this scam.”She also told specific stories of how various lenders suffered from the situation.

“We heard from one woman who used the proceeds from selling her mother’s home to purchase a Colony Ridge property, only to discover that she would need to spend thousands of dollars to set up infrastructure for basic utilities, despite being told that those services were 'ready' on the property," Clarke said.

The woman also was told the property would not flood but the flooding was so severe during heavy rains she was trapped in the development and could not leave, Clarke explained.

Colony Ridge, promoted to Hispanics as “Terrenos Houston” and “Terrenos Santa Fe,” totals about 40,000 lots in a large unincorporated area of Liberty County nearly 30 miles northeast of Houston.

Officials have estimated it covers an area like the nation’s capital city, the District of Columbia.

“Colony Ridge promised the American dream, but we allege that in reality, it has delivered a nightmare for thousands of hardworking Hispanic families who hoped to build their homes in the Terrenos Houston community,” Clarke said.

Attorney General Merrick Garland said the lawsuit is part of the Justice Department's Combating Redlining Initiative.

“Discrimination in lending harms families and neighborhoods for generations, it is wrong, and it has no place in our country, he said in a statement released by the Justice Department.

Redlining is the unlawful practice of denying minorities such as Blacks and Latinos loans or other services. It also targets low-income Americans because of the neighborhoods they live in.

Clarke sought to reassure people who had bought homes in Colony Ridge.

“I know you are hardworking people who are hoping to achieve the American dream of home ownership,” she said. “Through this lawsuit we are seeking to compensate those who have suffered losses due to these predatory practices.”

U.S. Attorney Alamdar Hamdani for the Southern District of Texas said the Hispanics who were targeted deserved better and rightfully expected more.

“Colony Ridge set out to exploit something as old as America — an immigrant’s dream of owning a home,” he said. Their practices “often ended with families facing economic ruin, no home, and shattered dreams.”

The Consumer Financial Protection Bureau and U.S. Department of Justice are asking anyone with information or additional claims to call a housing discrimination hotline at 833-591-0291 or email ColonyRidge.Lawsuit@usdoj.gov.