Business

Gustavo Petro's proposal: Colombia's richest should pay more taxes

The Colombian president proposed raising taxes on the country's wealthiest as part of a tax reform bill, his first legislative proposal

August 8, 2022 5:50pm

Updated: August 10, 2022 7:54am

Colombian President Gustavo Petro seeks to increase taxes on the country's wealthiest as part of an ambitious tax reform bill, his first major legislative proposal with which he intends to raise the resources needed to carry out what he promised in during his campaign.

The reform, titled "for Equality and Social Justice," was presented on Monday to the House of Representatives by Petro's cabinet. The leftist leader hopes to raise 25 trillion pesos by 2023, equivalent to $5.76 billion.

"Our objective is that people with more than 10 million monthly income ($2,300) pay, which are the 2% of the population with the highest income," Finance Minister José Antonio Ocampo told the press.

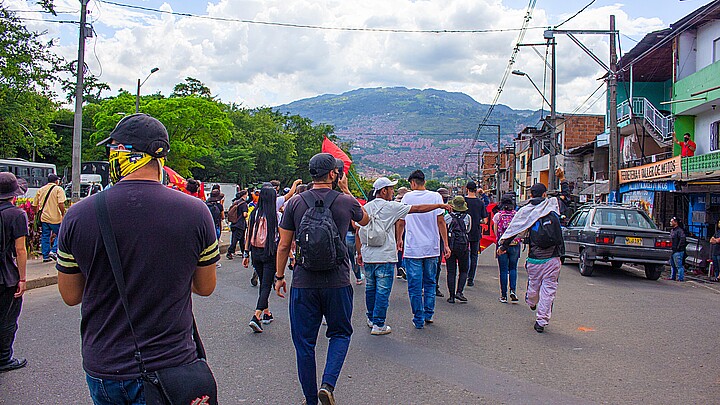

The amount to be raised is more ambitious than the amount approved in 2021 by the government of former President Iván Duque (2018-2022), who had to completely change his initial proposal after massive protests in the country. The demonstrations began after he announced that taxes would increase. Duque managed to approve a collection of 15.2 trillion pesos.

Petro said in his inauguration speech that this is "an act of solidarity," in which those with more resources would pay more taxes while the state would direct them towards the most vulnerable.

In addition, the bill proposes to reactivate the wealth tax for those with assets exceeding 3 billion pesos, equivalent to about $461,000.

If the data are put in an international context, an income of $10 million is equivalent to $2,305 (according to the Representative Market Rate fixed for today), which is relatively high among the countries of the region, reported the Colombian financial daily La República.

However, according to Ricardo Mora, a member of the Board of Directors of Progress SAI, if the Gross Domestic Product (GDP) per capita is taken into account, a person with an income of more than $10 million per month cannot be classified as upper class, reported the above-mentioned media.

According to Mora, Colombia continues to be the country with the lowest GDP per capita in the Organization for Economic Cooperation and Development (OECD), at $17,299 per capita, while Luxembourg's is $136,240, 7.9 times that of Colombia’s.

The bill also seeks to impose a new tax burden of 4.6% on oil exports, 7.6% on coal exports and 7.8% on gold. The minister considers that the three sectors are benefiting from "very high international prices" and their contribution would help finance social spending, reports The Associated Press (AP).

The tax reform proposes to limit benefits, but the tax rate remains the same at 35% for companies and 38% for financial entities, said the Minister of Finance.

The reform also includes new taxes on sugary beverages and ultra-processed food products, to encourage consumers to change to healthier habits, according to Ocampo, as well as a one-time tax on the sale and import of plastic products used for packaging to discourage their production and use.